If you regularly use one or more credit cards to make payments for your business, you might find yourself feeling confused about how to process these transactions in your bookkeeping software after the monthly statement arrives.

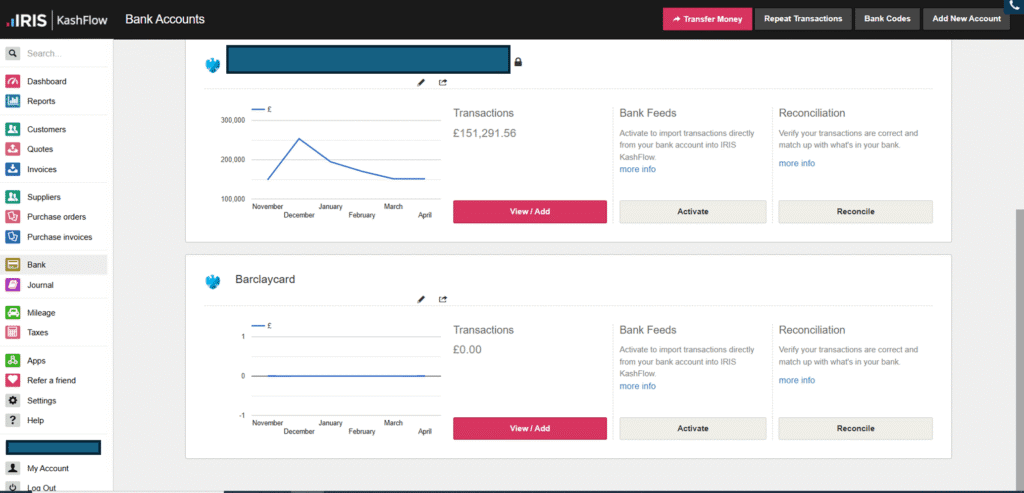

The first step is to set up the credit card up as a separate ‘bank account’ that you can make payments to and from.

Some credit cards have bank feeds available to automatically pull the transactions through into the bookkeeping software as would typically be the case with a standard current account.

Once you have the credit card set up as a bank account, you will be able to post transactions directly to the account and add payments to purchase invoices as you would with your current account.

If you reconcile your credit card purchases when you receive the monthly statement, there are two methods for processing these transactions to ensure that the information in Kashflow is accurate and complete.

Method 1:

When you receive the monthly Credit Card statement, you can add the transactions into Kashflow as follows:

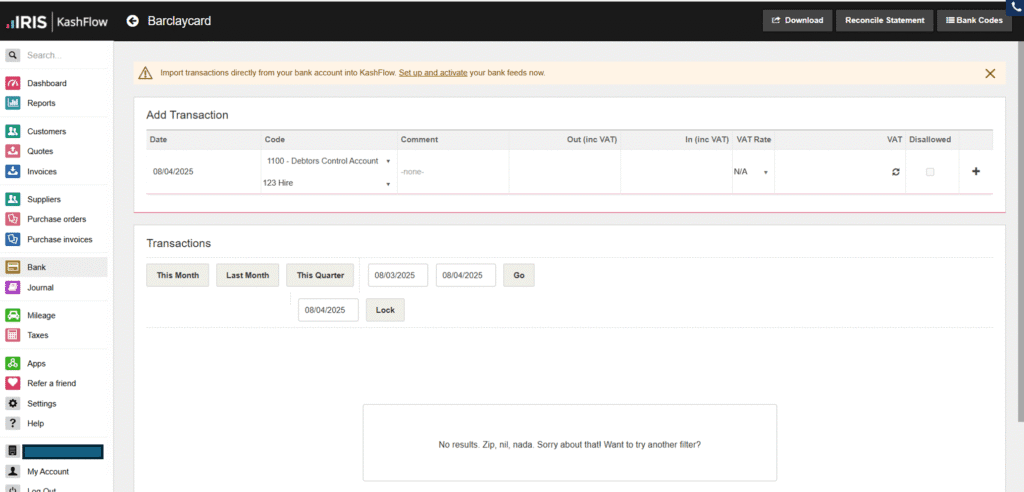

1. Go to Bank > Credit Card

2. Select “View/Add” to bring up the following page:

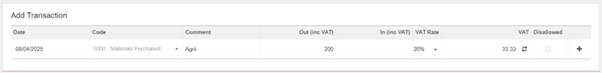

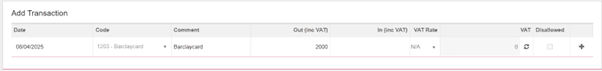

3. Fill in the information for each transaction and add by clicking the “+” button, e.g.:

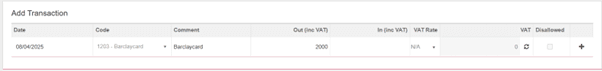

4. When the Credit Card is balance is paid, post this as a payment from the Current Account to the Credit Card as follows:

Method 2:

Alternatively, when you receive the monthly Credit Card statement, you can add the transactions into Kashflow as follows:

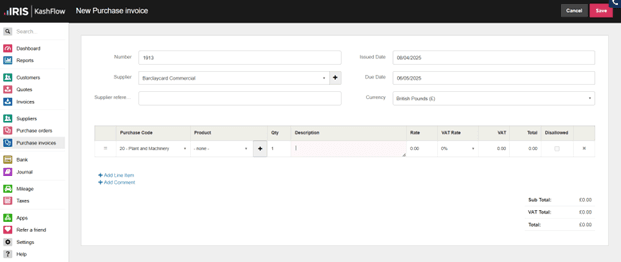

1. Create a Purchase Invoice to the Credit Card supplier:

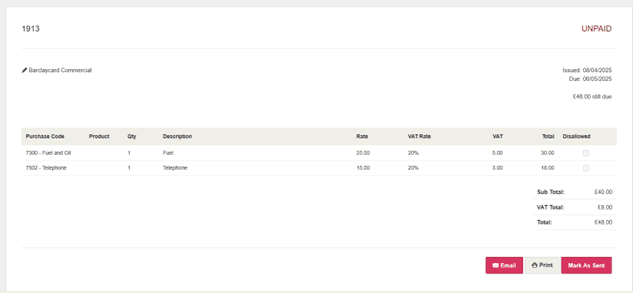

2. For each statement line, add a new line on the purchase invoice and categorise the expense. Once all transactions are added, click “Save”. This will result in a Purchase Invoice like the example below:

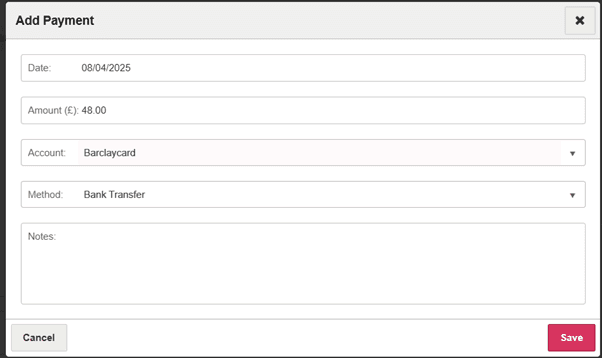

3. Scroll down on the same page and select “+ Add Payment” to bring up the following box:

4. Select the Credit Card in the account and click “Save”.

5. As with the previous method, when the Credit Card is balance is paid, post this as a payment from the Current Account to the Credit Card as follows:

Our cloud accounting experts in Bedfordshire, Cambridgeshire, and Hertfordshire are here to help you explore what works for your business, and to ensure you’re getting the most out of your chosen software.

If you’d like to find out more about how Xero could help you to improve the quality of your data, and so the discussions we are able to have with you about your business, please contact us.